At BeCloud, after helping organizations optimize cloud costs across healthcare, legal services, and professional services, we've observed a consistent—and often surprising—pattern:

Within 12–18 months, most organizations lose 60–70% of their initial cost savings.

Not because teams are careless or leadership inattentive—but because cost optimization was treated as a project rather than a practice.

Initial optimization efforts—rightsizing resources, eliminating obvious waste, and aligning baseline commitments—often deliver meaningful results. Many organizations see 20–30% reductions following an initial review.

The problem is not that these efforts fail.

It’s that they are treated as complete.

The limits of one-time cloud cost optimization

One-time optimization is effective—but temporary.

Cloud environments are dynamic by design:

New workloads are deployed

Teams scale and experiment

Usage patterns shift

Pricing models evolve

Without continuous oversight, yesterday’s optimization quietly becomes today’s inefficiency.

The result is predictable:

Gradual cost creep after early savings

New services deployed without financial visibility

Commitments drifting out of alignment with actual usage

Leadership reacting to spend instead of managing it proactively

In these environments, cost optimization becomes episodic—triggered by surprise rather than strategy.

The compounding value of continuous FinOps

Organizations that stop after initial optimization follow a familiar trajectory:

Month 1–3: 20–30% reduction achieved

Month 6–12: Savings erode as environments evolve

Month 18+: Costs approach baseline due to drift

Organizations with continuous FinOps practices experience a different outcome:

Month 1–3: Same initial reduction

Month 6–12: 35–40% sustained savings through ongoing adjustment

Month 18–24: 40–50% total reduction as deeper insights enable architectural optimization

The difference is not just sustainability—it is acceleration.

Continuous visibility enables optimization opportunities that are invisible during one-time audits: cost-per-user trends, unit economics by workload, forecasting accuracy, and commitment optimization.

FinOps does not merely preserve savings.

It compounds value over time.

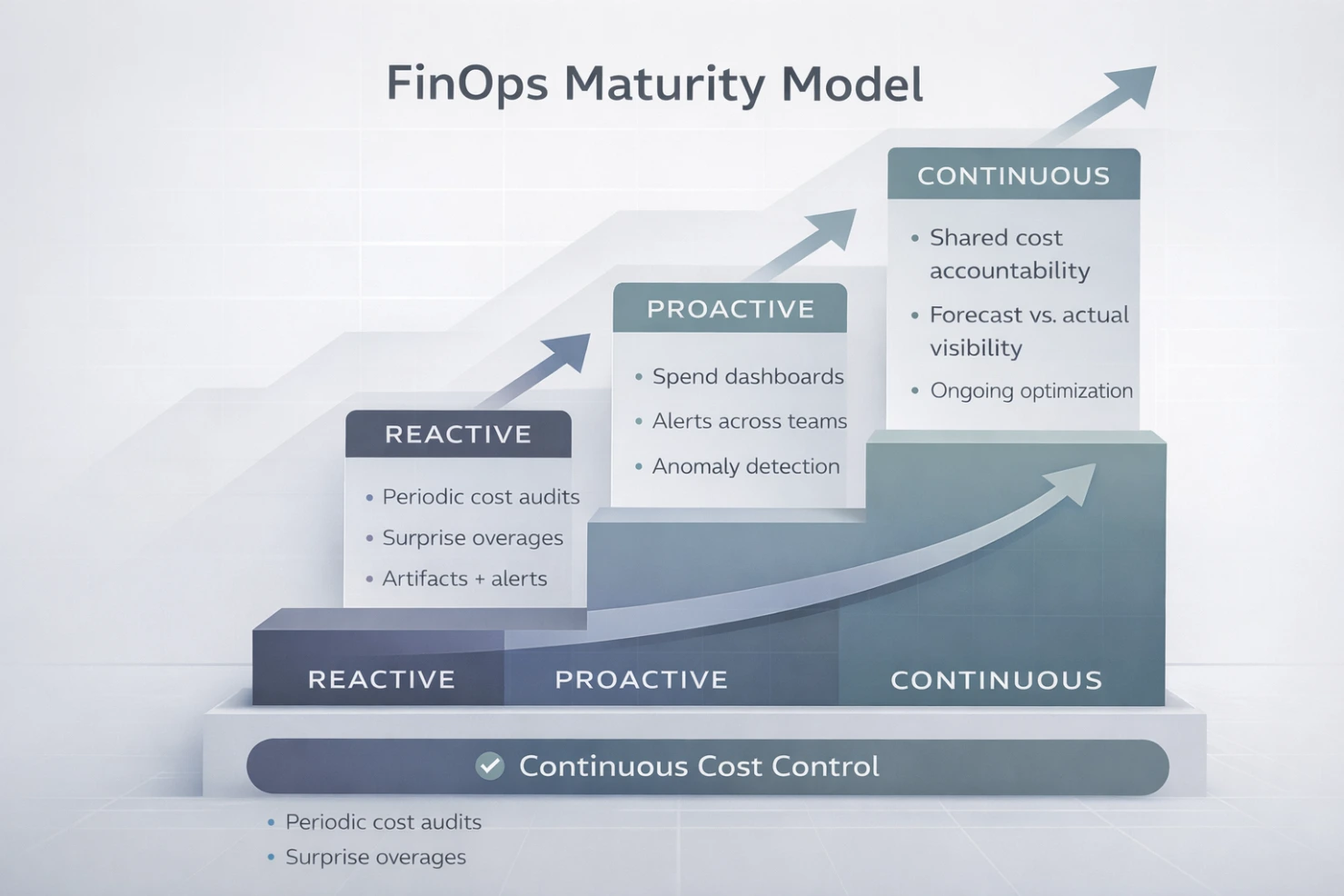

From audit to insight: the FinOps maturity curve

The difference between one-time optimization and sustained cost management is not frequency—it is depth.

Audits identify waste.

They surface idle resources, oversized instances, and unused commitments. This work is valuable, but inherently static.

FinOps creates intelligence.

With continuous monitoring, cost data becomes operational insight:

Spend is mapped to teams, projects, and outcomes

Accountability aligns with decision-making authority

Forecasts improve as patterns emerge

This enables leaders to move from “What did we spend?” to “Why does it matter—and what should we do next?”

What ongoing FinOps engagements enable

In sustained FinOps engagements, organizations begin answering questions audits cannot:

What is our cost per user—and how does it scale?

Which architectures deliver the best unit economics?

Where should we invest for growth versus optimize for efficiency?

Can we forecast costs confidently before launching new services?

We’ve seen this play out repeatedly:

A healthcare organization validated EHR modernization ROI using cost-per-patient metrics—supporting board-level decisions with data.

A professional services firm used cost-per-engagement insights to refine pricing and resource allocation.

A legal technology provider forecast onboarding costs accurately enough to turn infrastructure predictability into a sales advantage.

These outcomes do not come from dashboards alone.

They emerge from disciplined, continuous FinOps practice.

The real cost of episodic optimization

Organizations often view continuous FinOps as additional overhead. This misses the larger calculation.

Episodic optimization carries hidden costs:

Opportunity cost: months of invisible waste between audits

Decision risk: architecture choices made without unit-economics data

Productivity loss: reactive remediation cycles that disrupt planned work

Competitive drag: slower pricing, forecasting, and growth decisions

One client measured the business value enabled by continuous cost visibility—faster service launches, pricing optimization, confident capacity planning—and found an 8:1 return on their FinOps engagement in the first year.

The question is not whether FinOps costs money.

It is whether the cost of not knowing costs more.

The takeaway

One-time optimization delivers short-term savings.

Continuous FinOps delivers sustained control and strategic insight.

Organizations that adopt FinOps as an operating model move from reactive cost management to intentional, data-driven optimization—answering not just “What did we spend?” but “Why does it matter, and what should we do about it?”

Cost optimization is not a moment.

It is a management capability.